Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

The Surprising Trend in the Number of Homes Coming onto the Market

If you’re thinking about moving, it’s important to know what’s happening in the housing market. Here’s an update on the supply of homes currently for sale. Whether you’re buying or selling, the number of homes in your area is something you should pay attention to.

In the housing market, there are regular patterns that happen every year, called seasonality. Spring is the peak homebuying season and also when the most homes are typically listed for sale (homes coming onto the market are known in the industry as new listings). In the second half of each year, the number of new listings typically decreases as the pace of sales slows down.

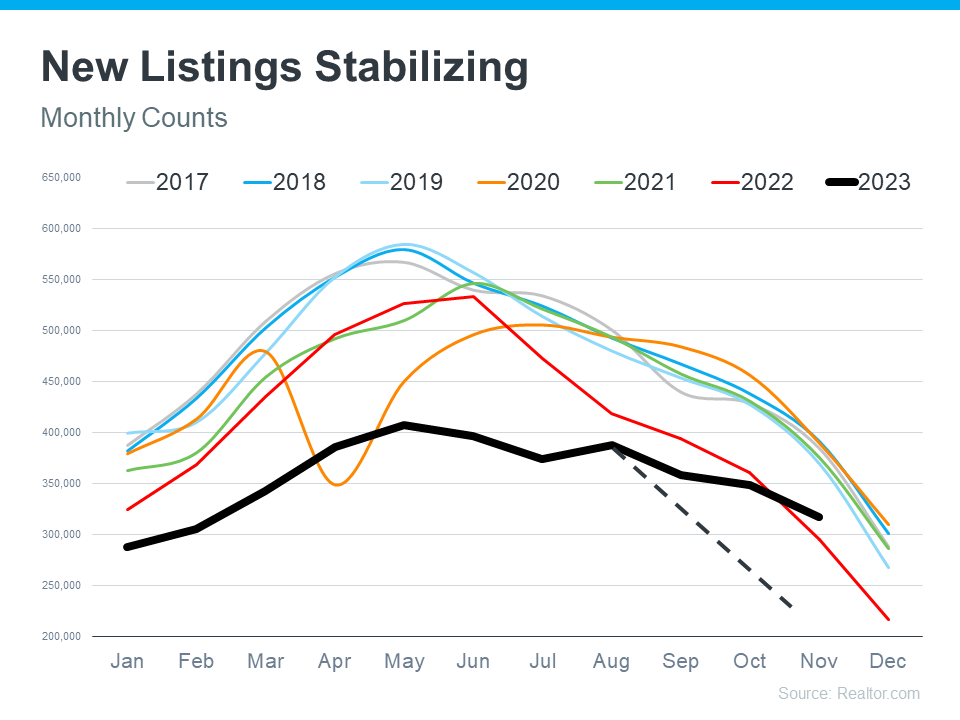

The graph below uses data from Realtor.com to provide a visual of this seasonality. It shows how this year (the black line) is breaking from the norm (see graph below):

Looking at this graph, three things become clear:

- 2017-2019 (the blue and gray lines) follow the same general pattern. These years were very typical in the housing market and their lines on the graph show normal, seasonal trends.

- Starting in 2020, the data broke from the normal trend. The big drop down in 2020 (the orange line) signals when the pandemic hit and many sellers paused their plans to move. 2021 (the green line) and 2022 (the red line) follow the normal trend a bit more, but still are abnormal in their own ways.

- This year (the black line) is truly unique. The steep drop off in new listings that usually occurs this time of year hasn’t happened. If 2023 followed the norm, the line representing this year would look more like the dotted black line. Instead, what’s happening is the number of new listings is stabilizing. And, there are even more new listings coming to the market this year compared to the same time last year.

What Does This Mean for You?

- For buyers, new listings stabilizing is a positive sign. It means you have a more steady stream of options coming onto the market and more choices for your next home than you would have at the same time last year. This opens up possibilities and allows you to explore a variety of homes that suit your needs.

- For sellers, while new listings are breaking seasonal norms, inventory is still well below where it was before the pandemic. If you look again at the graph, you’ll see the black line for this year is still lower than normal, meaning inventory isn’t going up dramatically and prices aren’t heading for a crash. And with less competition from other sellers than you’d see in a more typical year, your house has a better chance to be in the spotlight and attract eager buyers.

Bottom Line

Whether you’re on the hunt for your next home or thinking of selling, now might just be the perfect time to make your move. If you have questions or concerns about the availability of homes in our local area, let’s connect.

Down Payment Assistance Programs Can Help Pave the Way to Homeownership

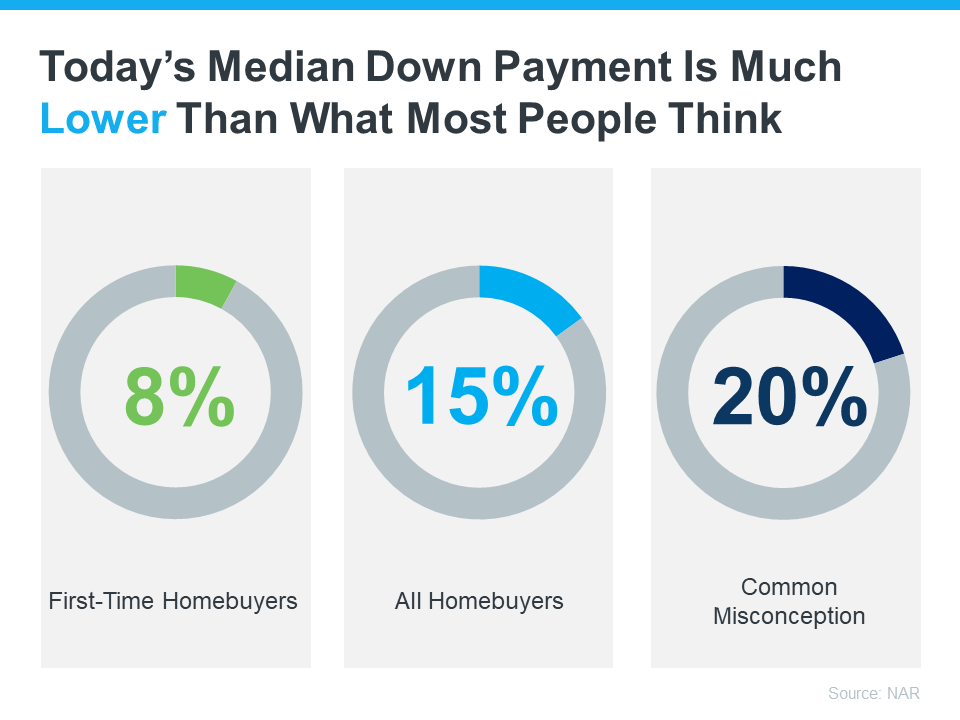

If you’re looking to buy a home, your down payment doesn’t have to be a big hurdle. According to the National Association of Realtors (NAR), 38% of first-time homebuyers find saving for a down payment the most challenging step. But the reality is, you probably don’t need to put down as much as you think:

Data from NAR shows the median down payment hasn’t been over 20% since 2005. In fact, the median down payment for all homebuyers today is only 15%. And it’s even lower for first-time homebuyers at 8%. But just because that’s the median, it doesn’t mean you have to put that much down. Some qualified buyers put down even less.

For example, there are loan types, like FHA loans, with down payments as low as 3.5%, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants. But let’s focus in on another valuable resource that may be able to help with your down payment: down payment assistance programs.

First-Time and Repeat Buyers Are Often Eligible

According to Down Payment Resource, there are thousands of programs available for homebuyers – and 75% of these are down payment assistance programs.

And it’s not just first-time homebuyers that are eligible. That means no matter where you are in your homebuying journey, there could be an option available for you. As Down Payment Resource notes:

“You don’t have to be a first-time buyer. Over 39% of all [homeownership] programs are for repeat homebuyers who have owned a home in the last 3 years.”

The best place to start as you search for more information is with a trusted real estate professional. They’ll be able to share more information about what may be available, including additional programs for specific professions or communities.

Additional Down Payment Resources That Can Help

Here are a few down payment assistance programs that are helping many of today’s buyers achieve the dream of homeownership:

- Teacher Next Door is designed to help teachers, first responders, health providers, government employees, active-duty military personnel, and veterans reach their down payment goals.

- Fannie Mae provides down-payment assistance to eligible first-time homebuyers living in majority-Latino communities.

- Freddie Mac also has options designed specifically for homebuyers with modest credit scores and limited funds for a down payment.

- The 3By30 program lays out actionable strategies to add 3 million new Black homeowners by 2030. These programs offer valuable resources for potential buyers, making it easier for them to secure down payments and realize their dream of homeownership.

- For Native Americans, Down Payment Resource highlights 42 U.S. homebuyer assistance programs across 14 states that ease the path to homeownership by providing support with down payments and other associated costs.

Even if you don’t qualify for these types of programs, there are many other federal, state, and local options available to look into. And a real estate professional can help you find the ones that meet your needs as you explore what’s available.

Bottom Line

Achieving the dream of having a home may be more within reach than you think, especially when you know where to find the right support. To learn more about your options, let’s connect.

The Perfect Home Could Be the One You Perfect After Buying

There’s no denying mortgage rates and home prices are higher now than they were last year and that’s impacting what you can afford. At the same time, there are still fewer homes available for sale than the norm. These are two of the biggest hurdles buyers are facing today. But there are ways to overcome these things and still make your dream of homeownership a reality.

As you set out to make a purchase this season, you’ll want to be strategic. This includes taking a close look at your wish list and considering what features you really need in your next home versus which ones are nice-to-have. This will help you avoid overextending your budget or limiting your pool of options too much because you’re searching for that perfect home.

Danielle Hale, Chief Economist at Realtor.com, explains:

“The key to making a good decision in this challenging housing market is to be laser focused on what you need now and in the years ahead, . . . Another key point is to avoid stretching your budget, as tempting as it may be . . .”

To help identify what you truly need, make a list of all the features you’ll want to see. From there, work to break those features into categories. Here’s a great way to organize your list:

- Must-Haves – If a house doesn’t have these features, it won’t work for you and your lifestyle (examples: distance from work or loved ones, number of bedrooms/bathrooms, etc.).

- Nice-To-Haves – These are features you’d love to have but can live without. Nice-to-haves aren’t dealbreakers, but if you find a home that hits all the must-haves and some of these, it’s a contender (examples: a second home office, a garage, etc.).

- Dream State – This is where you can really think big. Again, these aren’t features you’ll need, but if you find a home in your budget that has all the must-haves, most of the nice-to-haves, and any of these, it’s a clear winner (examples: a pool, multiple walk-in closets, etc.).

If you’re only willing to tour homes that have all of your dream features, you may be cutting down your options too much and making it harder on yourself (and your budget) than necessary.

While you’d love to have granite countertops or a pool in the backyard, those are both things you could potentially add after you move. Instead, it may be best to focus on finding the things that you can’t change (like location or a certain number of rooms). Then, you can upgrade or add some of the other features or finishes you want later on.

Sometimes the perfect home is the one you perfect after buying it.

Once you’ve categorized your list in a way that works for you, discuss your top priorities with your real estate agent. They’ll be able to help you refine the list further, coach you through the best way to stick to it, and find a home in your area that meets your top needs.

Bottom Line

With the current affordability challenges and limited housing supply, you’ll want to be strategic so you can find a home that meets your needs while staying within your budget. Let’s connect to make that possible.

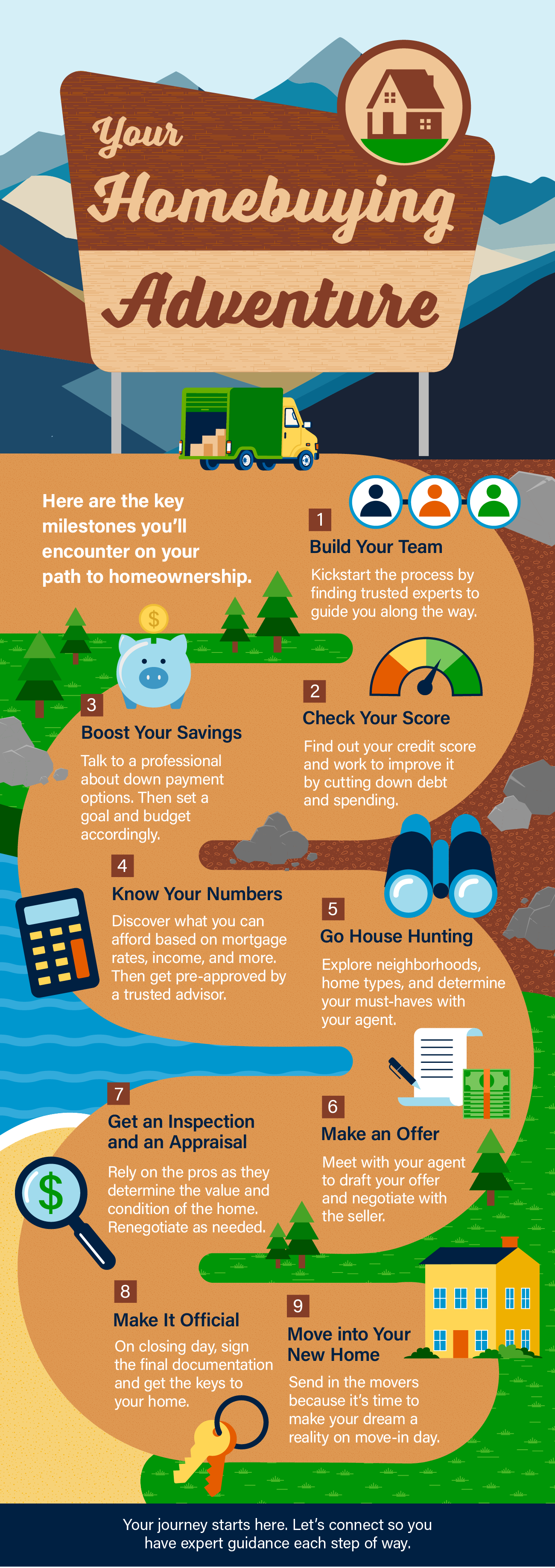

Your Homebuying Adventure

Some Highlights

- Here are the key milestones you’ll encounter on your path to homeownership.

- From building your team, to house hunting, all the way to moving into your new home – it’s an exciting adventure.

- Your journey starts here. Let’s connect so you have expert guidance each step of the way.

Why You Should Use a Real Estate Agent When You Buy a Home

If you’ve recently decided you’re ready to become a homeowner, chances are you’re trying to figure out what to do first. It can feel a bit overwhelming to know where to start, but the good news is you don’t have to navigate all of that alone.

When it comes to buying a home, there are a lot of moving pieces. And that’s especially true in today’s housing market. The number of homes for sale is still low, and home prices and mortgage rates are still high. That combination can be tricky if you don’t have reliable expertise and a trusted advisor on your side. That’s why the best place to start is connecting with a local real estate agent.

Agents Are the #1 Most Useful Source in the Buying Process

The latest annual report from the National Association of Realtors (NAR) finds recent homebuyers agree the #1 most useful source of information they had in the home buying process was a real estate agent. Let’s break down why.

How an Agent Helps When You Buy a Home

When you think about a real estate agent, you may think of someone taking you on home showings and putting together the paperwork, but a great agent does so much more than that. It’s not just being the facilitator for your purchase, it’s being your guide through every step.

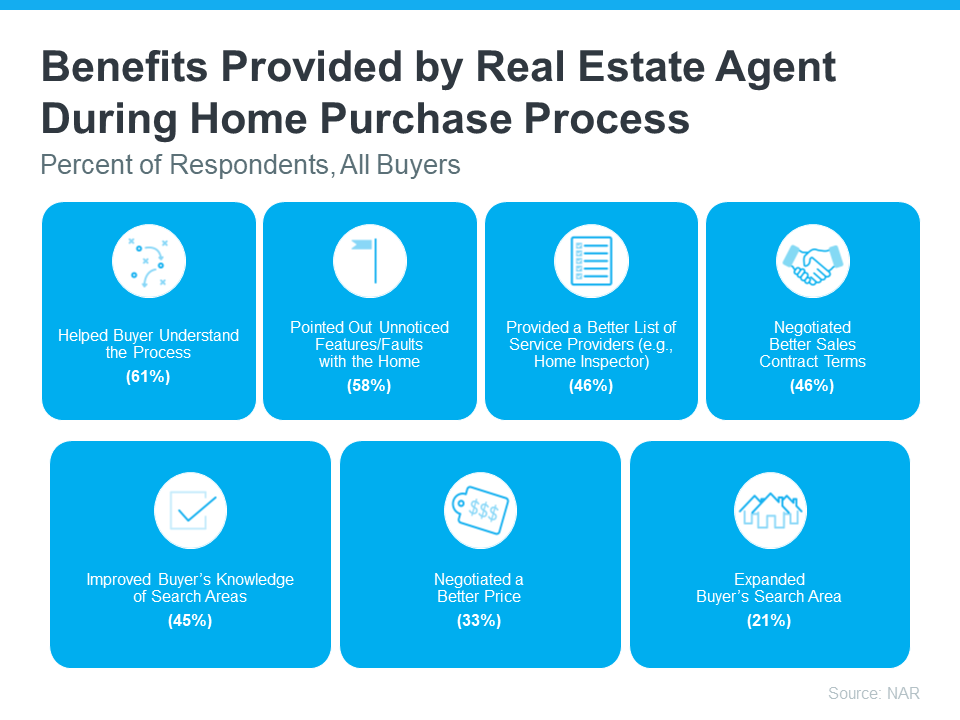

The visual below shows some examples from that same NAR release of the many ways an agent adds value. It includes the percentage of homebuyers in that report who highlighted each of these benefits:

Here’s a bit more context on how the survey results noted an agent continually helps buyers in these situations:

- Helped Buyer’s Understand the Process: Do you know the difference between an inspection and an appraisal, what each report tells you, and why they’re both important? Or that there are things you shouldn’t do after applying for a mortgage, like buying appliances or furniture? An agent knows all of these best practices and will share them with you along the way, so you don’t miss any key steps by the time you get to the closing table.

- Pointed Out Unnoticed Features or Faults with the Home: An agent also has a lot of experience evaluating homes. They’ve truly seen it all. They’ll be able to pinpoint some things you may not have noticed about the home that could help inform your decision or at least what repairs you ask for.

- Provided a Better List of Service Providers: In a real estate transaction, there are a lot of people involved. An agent has experience working with various professionals in your area, like home inspectors, and can help connect you with the pros you need for a successful experience.

- Negotiated Better Contract Terms and Price: Did something pop up in the home inspection or with the appraisal? An agent will help you re-negotiate as needed to get the best terms and price possible for you, so you feel confident with your big purchase.

- Improved Buyer’s Knowledge of the Search Area: Moving to a new town and you’re not familiar with the area, or you’re staying nearby, but don’t know which neighborhoods are most affordable? Either way, an agent knows the local area like the back of their hand and can help you find the perfect location for your needs.

- Expanded Buyer’s Search Area: And if you’re not finding anything you’re interested in within your initial search radius, an agent will know other neighborhoods nearby you should consider based on what you like, what amenities you want, and more.

Bottom Line

If you’re looking to buy a home, don’t forget about the many ways an agent is essential to that process. Any hurdle that pops up, a negotiation that needs to take place, and more, your agent will know how to handle it while they make sure to minimize your stress along the way. Let’s connect to tackle this together.

How To Turn Homeownership into a Side Hustle

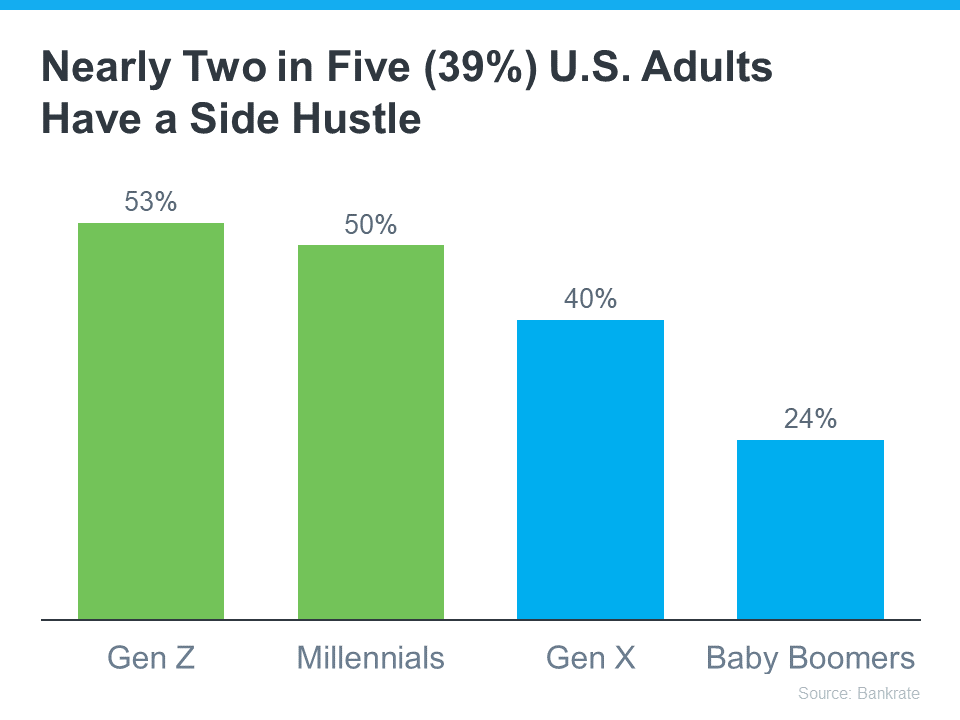

Does the rising cost of just about everything these days make your dream of owning your own home feel less within reach? According to Bankrate, many people are seeking additional income through side hustles, possibly to cope with those increasing expenses and save for a home. This trend is particularly popular with younger individuals who may be dealing with student loan debt (see graph below):

Here are two strategies that can not only make homeownership more affordable in the short term, but turn it into a lucrative side hustle that can pay off down the road.

Transforming the Challenge of a Fixer-Upper into an Opportunity

One thing you could do to help you break into homeownership is consider purchasing a fixer-upper. That’s a home that may be a bit less appealing and as a result has lingered on the market longer than normal. According to a recent article from U.S. News:

“The current state of the housing market may have you expanding your options to try to find a home that you can afford. A fixer-upper that needs some updating and a little love can feel like a welcome alternative to move-in ready houses that go off the market before you can even take a tour.”

By opting for a home that requires some work, you may see two big benefits. For starters, you may find it’s easier to find a home because you’re not looking for that perfect option. Plus, it may also help you enter the housing market at a lower price point. This strategy provides a more affordable way to become a homeowner while also offering the potential for future profits.

Yes, the home may need a little elbow grease, but investing time and effort into gradually enhancing your house not only makes it a home but also increases its future market value. So, while you enjoy the satisfaction of turning a house into a home, you’re also building equity that can be unlocked when it’s time to sell.

Renting Out a Portion of Your Home To Make It More Affordable

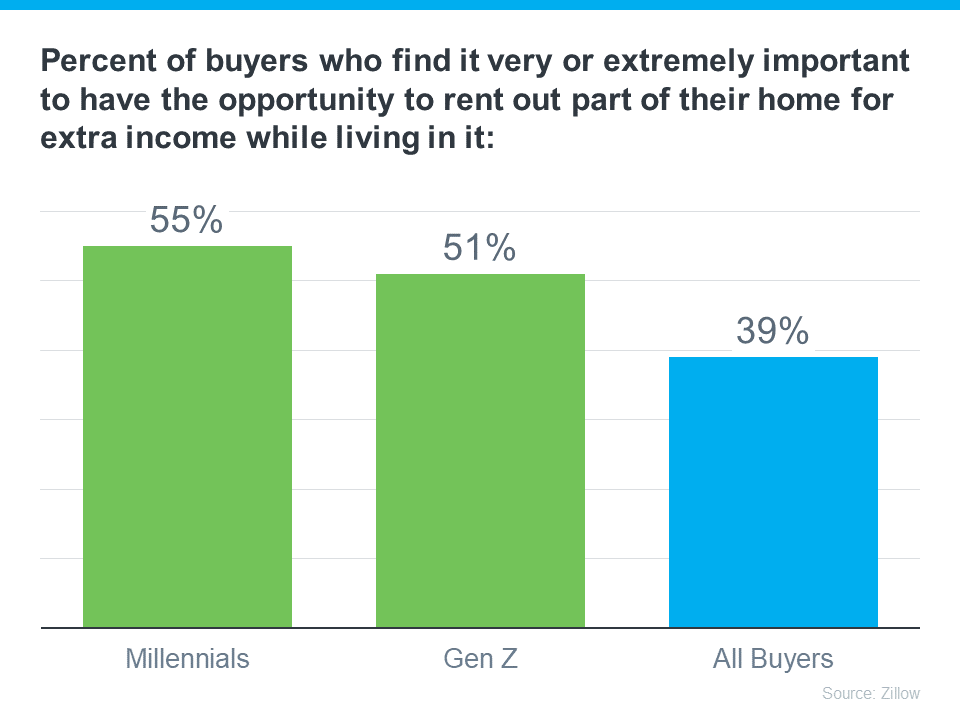

Another savvy strategy is to purchase a home with the upfront intention of renting out a portion of it. According to a recent press release from Zillow, renting out a part of their home is already very important for most young homebuyers (see graph below):

This approach serves a strong purpose. As Manny Garcia, Senior Population Scientist at Zillow, says:

“For those first-time buyers navigating the ‘side hustle culture,’ where a regular 9-to-5 might not quite cut it for homeownership dreams, rental income can step in to help . . .”

Basically, it can help you afford your monthly mortgage payments. So if you’re open to it, renting out a portion of your home not only helps with affordability, but it also positions you as an investor and turns your home into a source of income.

Bottom Line

In the face of today’s affordability challenges, both of these strategies offer more attainable paths to homeownership, especially for younger buyers. If you want to discuss these options and see how they might play out for you in our local market, let’s connect.

When You Sell Your House, Where Do You Plan To Go?

If you’re thinking about selling your house, you may have heard the supply of homes for sale is still low, and that means your house should stand out to buyers who are craving more options. But you may also be wondering, once you sell, how does the current supply impact your own move? And, will you be able to find a home you want to buy with inventory this low?

One thing that can help you find your next home is exploring all your options, including both homes that have been lived in before as well as newly built ones. Let’s look at the benefits of each one.

The Pros of Newly Built Homes

First, let’s look at the advantages of purchasing a newly constructed home. With a brand-new home, you’ll be able to:

- Create your perfect home. If you build a home from the ground up, you’ll have the option to select the custom features you want, including appliances, finishes, landscaping, layout, and more.

- Cash-in on energy efficiency. When building a home, you can choose energy-efficient options to help lower your utility costs and reduce your carbon footprint.

- Minimize the need for repairs. Many builders offer a warranty, so you’ll have peace of mind on unlikely repairs. Plus, you won’t have as many little projects to tackle.

- Have brand new everything. Another perk of a new home is that nothing in the house is used. It’s all brand new and uniquely yours from day one.

The Pros of Existing Homes

Now, let’s compare that to the perks that come with buying an existing home. With a pre-existing home, you can:

- Explore a wider variety of home styles and floorplans. With decades of homes to choose from, you’ll have a broader range of floorplans and designs available.

- Join an established neighborhood. Existing homes give you the option to get to know the neighborhood, community, or traffic patterns before you commit.

- Enjoy mature trees and landscaping. Established neighborhoods also have more developed landscaping and trees, which can give you additional privacy and curb appeal.

- Appreciate that lived-in charm. The character of older homes is hard to reproduce. If you value timeless craftsmanship or design elements, you may prefer an existing home.

The choice is yours. When you start your search for the perfect home, remember that you can go either route – you just need to decide which features and benefits are most important to you. As an article from The Mortgage Reports says:

“When building, you gain more freedom to tailor the design, materials, and features, but it demands more time and involvement. Conversely, buying an established home offers immediate occupancy . . . yet may require compromises. Your choice should align with your budget, timeline, customization preferences, and the local real estate landscape.”

Either way, working with a local real estate agent throughout the process is mission-critical to your success. They’ll help you explore all of your options based on what matters most to you in your next home. Together, you can find the home that’s right for you.

Bottom Line

If you have questions about the options in our area, let’s discuss what’s available and what’s right for you. That way you’ll be ready to make your next move with confidence.

Experts Project Home Prices Will Rise over the Next 5 Years

Even with so much data showing home prices are actually rising in most of the country, there are still a lot of people who worry there will be another price crash in the immediate future. In fact, a recent survey from Fannie Mae shows that 23% of consumers think prices will fall over the next 12 months. That’s nearly one in four people who are dealing with that fear – maybe you’re one of them.

To help ease that concern, here’s what the experts say will happen with home prices not just next year, but over the next five years.

Experts Project Ongoing Appreciation

While seeing a small handful of expert opinions may not be enough to change your mind, hopefully, a larger group of experts will reassure you. Here’s that larger group.

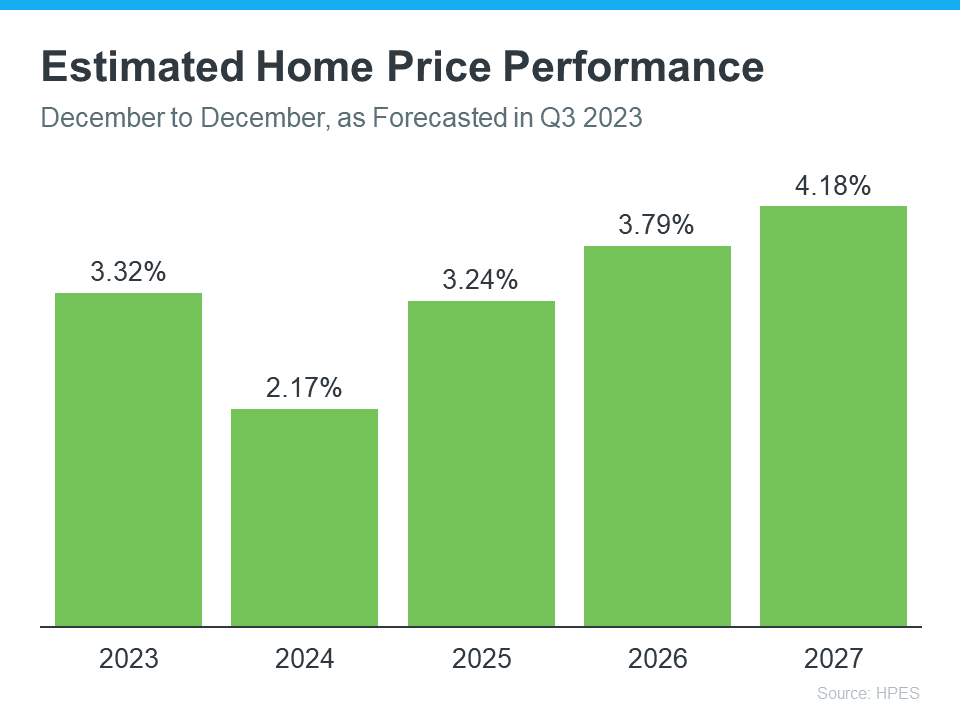

The Home Price Expectation Survey (HPES) from Pulsenomics is a great resource to show what experts forecast for home prices over a five-year period. It includes projections from over 100 economists, investment strategists, and housing market analysts. And the results from the latest quarterly release show home prices are expected to go up every year through 2027 (see graph below):

And while the projected increase in 2024 isn’t as large as 2023, remember home price appreciation is cumulative. In other words, if these experts are correct after your home’s value rises by 3.32% this year, it should go up by another 2.17% next year.

If you’re worried home prices are going to fall, here’s the big takeaway. Even though prices vary by local area, experts project they’ll continue to rise across the country for years to come at a pace that’s more normal for the market.

What Does This Mean for You?

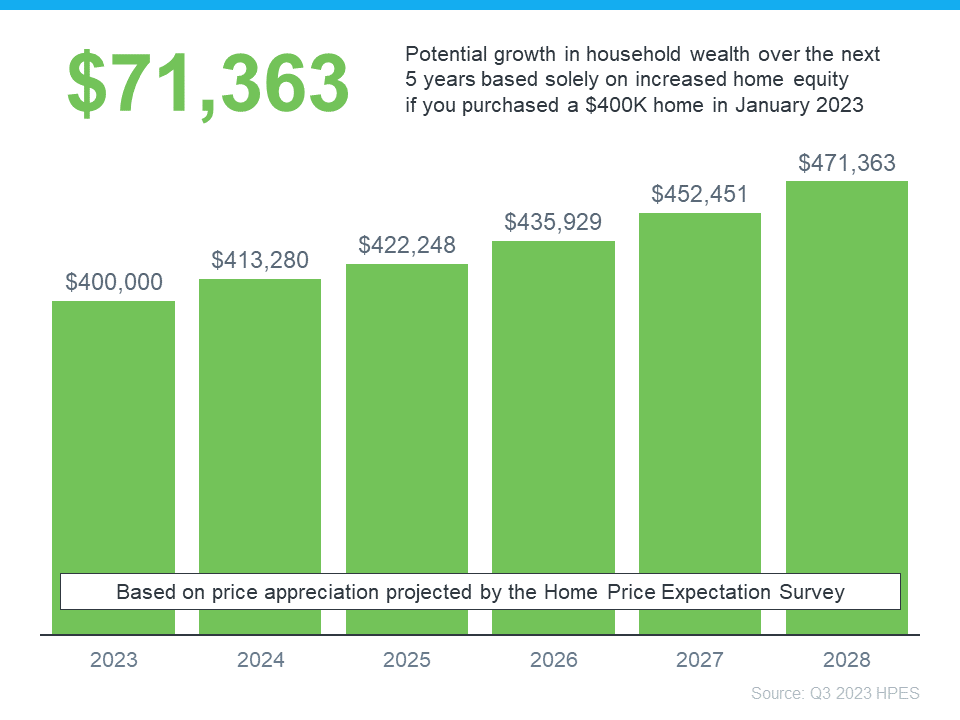

If you’re not convinced yet, maybe these numbers will get your attention. They show how a typical home’s value could change over the next few years using the expert projections from the HPES. Check out the graph below:

In this example, let’s say you bought a $400,000 home at the beginning of this year. If you factor in the forecast from the HPES, you could potentially accumulate more than $71,000 in household wealth over the next five years.

Bottom Line

If you’re someone who’s worried home prices are going to fall, rest assured a lot of experts say it’s just the opposite – nationally, home prices will continue to climb not just next year, but for years to come. If you have any questions or concerns about what’s next for home prices in our local area, let’s connect.

Is Owning a Home Still the American Dream for Younger Buyers?

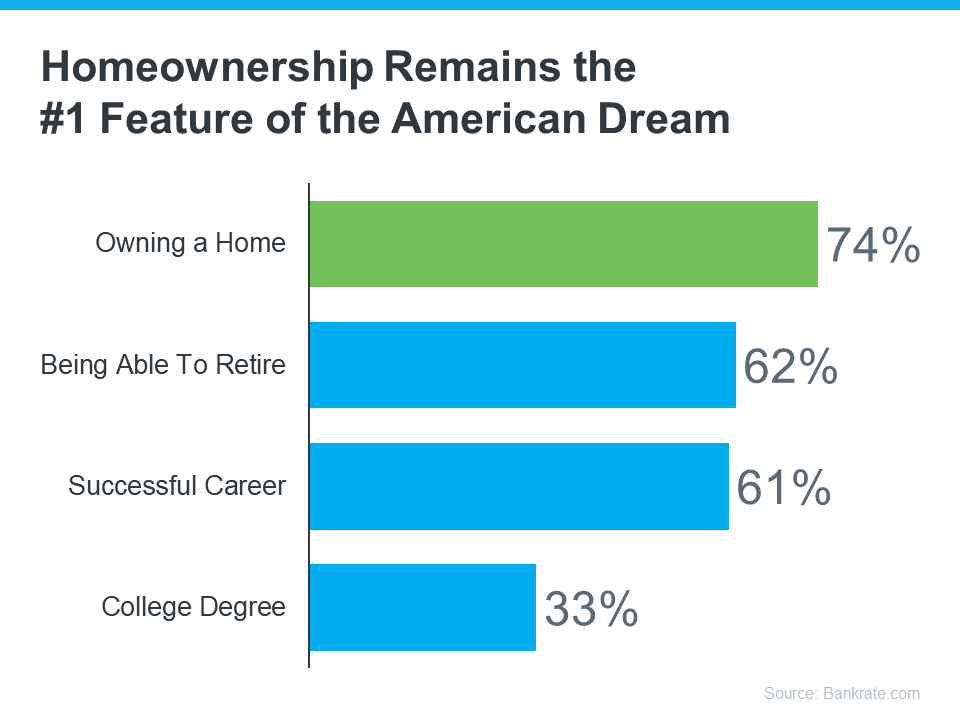

Everyone has their own idea of the American Dream, and it’s different for each person. But, in a recent survey by Bankrate, people were asked about the achievements they believe represent the American Dream the most. The answers show that owning a home still claims the #1 spot for many Americans today (see graph below):

In fact, according to the graph, owning a home is more important to people than retiring, having a successful career, or even getting a college degree. But is the dream of homeownership still alive for younger generations?

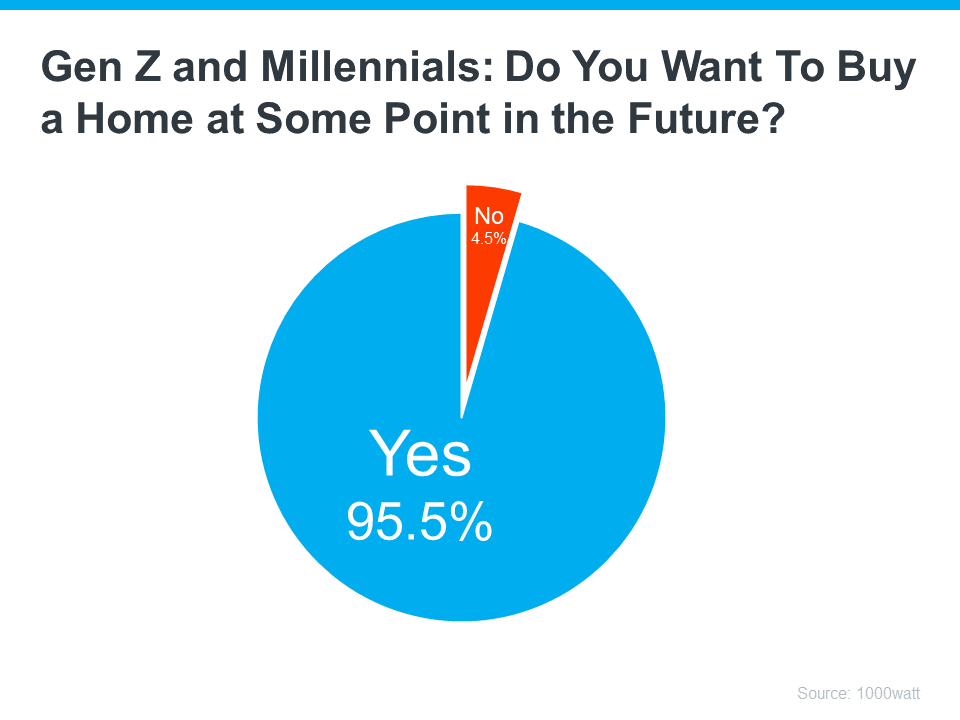

A recent survey by 1000watt dives into how the two generations many people believed would be the renter generations (Gen Z and millennials) feel about homeownership. Specifically, it asks if they want to buy a home in the future. The resounding answer is yes (see graph below):

While there are plenty of reasons why someone might prefer homeownership to renting, the same 1000watt survey shows, that for 63% of Gen Z and millennials, it’s that your place doesn’t feel like “home” unless you own it – maybe you feel the same way.

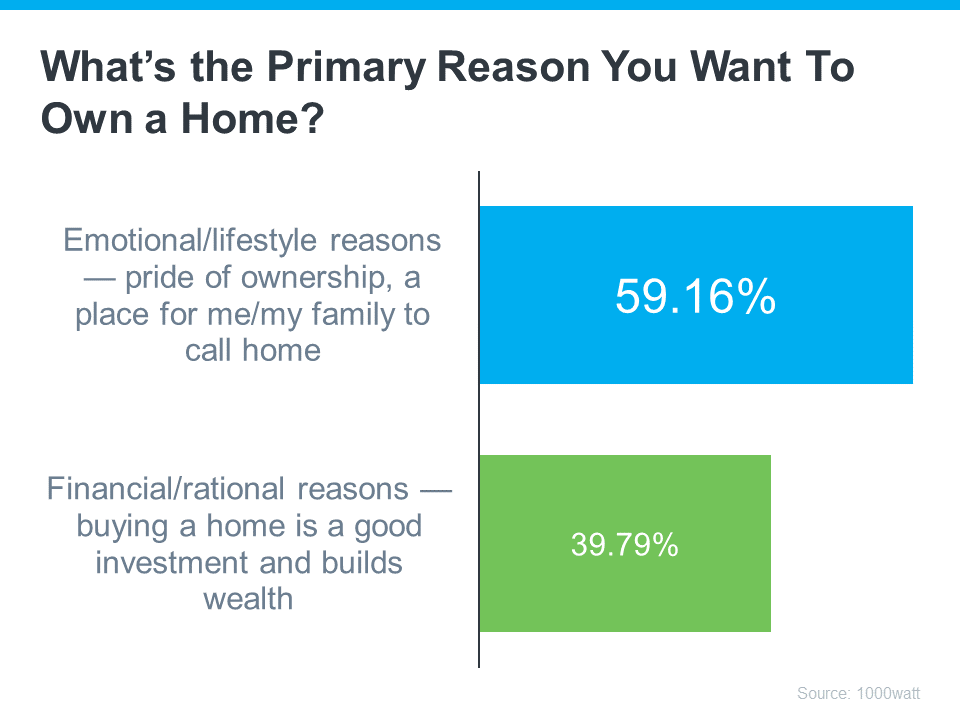

That emotional draw is further emphasized when you look at the reasons why Gen Z and millennials want to become homeowners. For all the financial benefits homeownership provides, in most cases it’s about the lifestyle or emotional benefits (see graph below):

What Does This Mean for You?

If you’re a part of Gen Z or are a millennial and you’re ready, willing, and able to buy a home, you’ll want a great real estate agent by your side. Their experience and expertise in the local housing market will help you overcome today’s high mortgage rates, low inventory, and rising home prices to find your first home and turn your dream into a reality.

Working with a local real estate agent to find your dream home is the key to unlocking the American Dream.

Bottom Line

Buying a home is a big, important decision that represents the heart of the American Dream. If you want to accomplish your goal, let’s connect to start the process today.

Is Wall Street Buying Up All the Homes in America?

If you’re thinking about buying a home, you may find yourself interested in the latest real estate headlines so you can have a pulse on all of the things that could impact your decision. If that’s the case, you’ve probably heard mention of investors, and wondered how they’re impacting the housing market right now. That could leave you asking yourself questions like:

- How many homes do investors own?

- Are institutional investors, like large Wall Street Firms, really buying up so many homes that the average person can’t find one?

To answer those questions, here’s the real story of what’s happening based on the data.

Let’s start with establishing how many single-family homes (SFHs) there are and what portion of those are rentals owned by investors. According to SFR Investor, which studies the single-family rental market in the United States, there are eighty-two million single-family homes in this country. But how many of them are actually rentals?

According to data shared in a recent post, sixty-eight million (82.93%) of those homes are owner-occupied – meaning the person who owns the home lives in it. If you subtract that sixty-eight million from the total number of single-family homes (82 million), that leaves just about fourteen million homes left that are single-family rentals (SFRs).

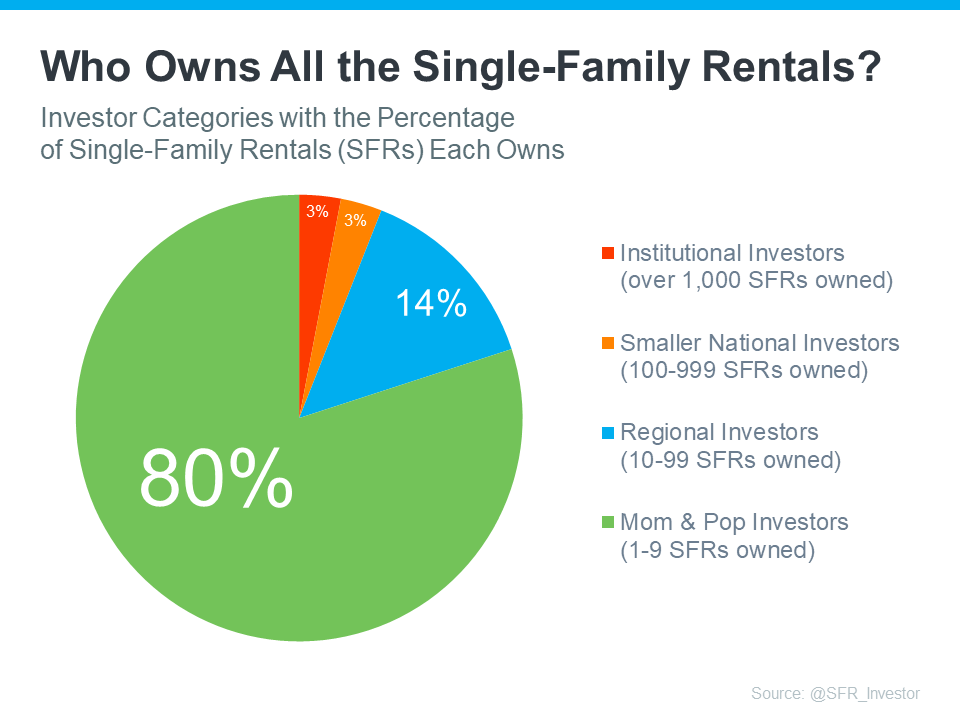

Do institutional investors own all of those remaining fourteen million homes? Not even close. Let’s take it one step further. There are four categories of investors:

- The mom & pop investor who owns between 1-9 SFRs

- The regional investor who owns between 10-99 SFRs

- Smaller national investor who owns between 100-999 SFRs

- The institutional investor who owns over 1,000 SFRs

These categories show that not all investors are large institutional investors. To help convey that even more clearly, here are the percentages of rental homes owned by each type of investor (see chart below):

As you can see in the chart, despite what the news and social media would have you believe, the green shows the vast majority are not owned by large institutional investors. Instead, most are owned by small mom & pop investors, like your friends and neighbors.

What’s actually happening is, that there are people out there, just like you, who believe in homeownership, and they view buying a home (or a second home) as an investment. Maybe they saw an opportunity to buy a second home over the last few years to use it as a rental and generate additional income. Or maybe they just decided to keep their first house rather than sell it when they moved up.

So, don’t believe everything you read or hear about institutional investors. They aren’t buying up all the homes and making it impossible for the average person to buy. That’s just not what the numbers show. Institutional investors are actually the smallest piece of the pie chart.

Bottom Line

While it’s true that institutional investors are a player in the single-family rental marketplace, they’re not buying up all of the houses on the market. If you have other questions about things you’re hearing about the housing market, let’s connect so you have an expert to give you the context you need.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link